The move, announced Tuesday by Beijing‘s Commerce Ministry, could propel the economic rivalry between the two powers and their respective supply chains.

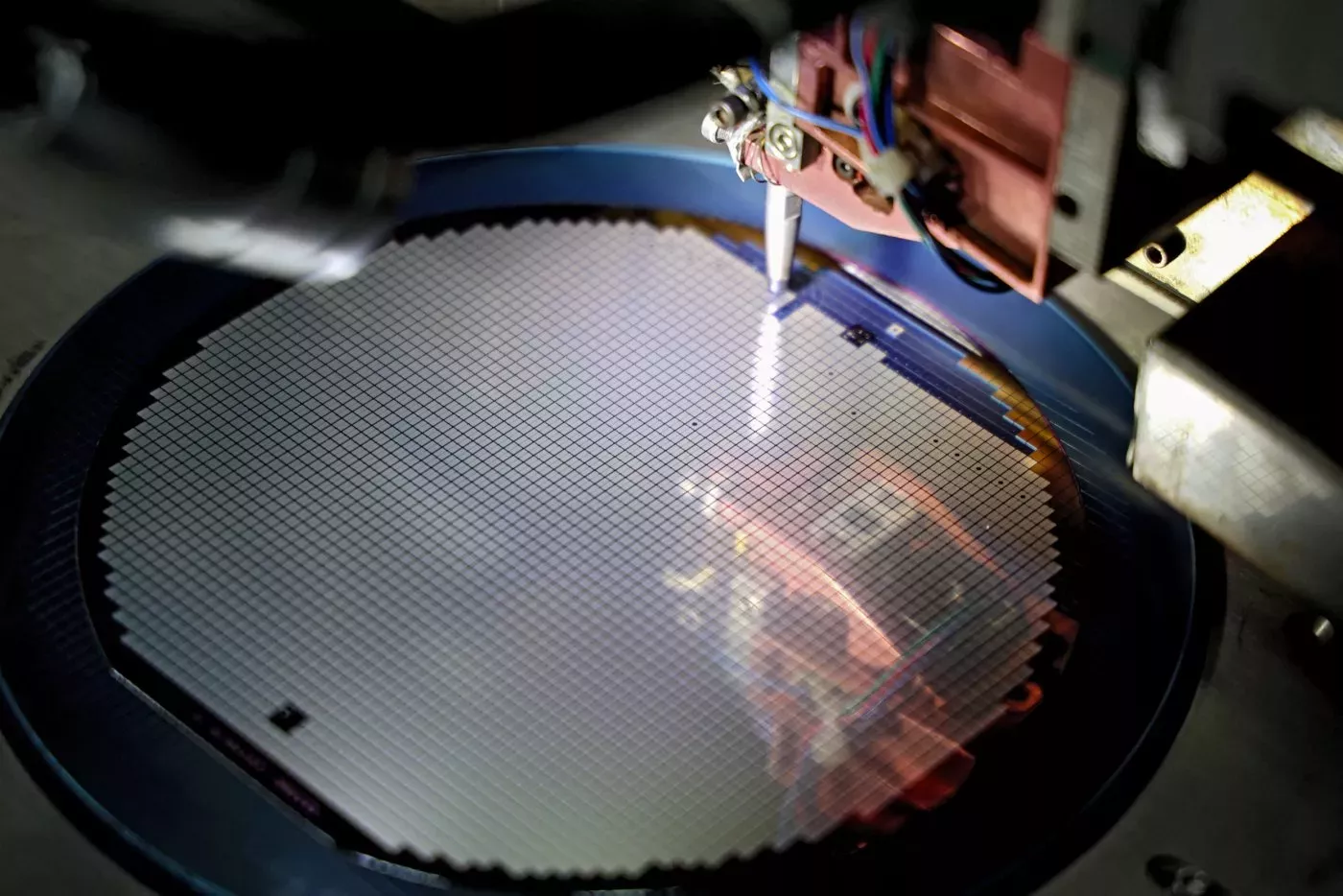

China has explicitly decided to target crucial materials for the production semiconductors, mobile devices, solar panels, and defense systems.

Beijing’s action follows Washington‘s expansion of its “entity list,” which added 140 Chinese companies subjected to strict export controls on semiconductor-making equipment and advanced chip technology.

Lin Jian, China’s Foreign Ministry spokesperson said they firmly oppose “the U.S. overstretching the concept of national security” in order to abuse export control measures and unilateral sanctions, which they called “legal.”

It produces 60 percent of the world’s germanium and 98 percent of its gallium, according to U.S. Geological Survey data. The U.S. relies on China for about half its supply of gallium and germanium.

In 2022 alone, China exported 23 metric tons of gallium, an amount essential for manufacturing high-bandwidth memory chips and military hardware.

Though America has untapped deposits, it lacks active mining operations for these materials, leaving industries vulnerable to price shocks.

Beijing’s retaliation directly counters President Joe Biden‘s efforts to curb China’s technological advancements.

Washington’s recent export controls aim to block Chinese access to cutting-edge technologies. The U.S. Department of Commerces’ new rules, which primarily affect Chinese companies, will also affect firms in Japan, South Korea, and Singapore.

China had initially taken a cautious approach to U.S. trade measures, perhaps to protect its developing semiconductor and artificial intelligence industries.

Recent responses signal a shift in strategy. By targeting minerals essential for the global tech economy, China is leveraging its near-monopoly to assert its influence.

Beijing’s retaliation directly counters President Joe Biden‘s efforts to curb China’s technological advancements.

Washington’s recent export controls aim to block Chinese access to cutting-edge technologies. The U.S. Department of Commerces’ new rules, which primarily affect Chinese companies, will also affect firms in Japan, South Korea, and Singapore.

China had initially taken a cautious approach to U.S. trade measures, perhaps to protect its developing semiconductor and artificial intelligence industries.

Recent responses signal a shift in strategy. By targeting minerals essential for the global tech economy, China is leveraging its near-monopoly to assert its influence.

Beijing’s retaliation directly counters President Joe Biden‘s efforts to curb China’s technological advancements.

Washington’s recent export controls aim to block Chinese access to cutting-edge technologies. The U.S. Department of Commerces’ new rules, which primarily affect Chinese companies, will also affect firms in Japan, South Korea, and Singapore.

China had initially taken a cautious approach to U.S. trade measures, perhaps to protect its developing semiconductor and artificial intelligence industries.

Recent responses signal a shift in strategy. By targeting minerals essential for the global tech economy, China is leveraging its near-monopoly to assert its influence.